LPGinfo.co.uk

Unbiased Autogas!

| CREDIT CARD CO |

Paying for a conversion Paying over £2000 pounds for a single transaction is not an easy thing to do and hence, I am surprised when people make such large purchases with cash, cheque or debit card as such payment methods use ones' own cleared funds - in basic terms, the money goes directly from your bank account! Using a credit card Paying by credit card means that there is an intermediary (or middle-man) between you and the person/company the transaction is with. In simple terms, your credit card company pays for the transaction and then you pay your credit card company when your bill comes through. "Hmm.. so what's so good about that?" you ask.. well, under Section 75 of the Consumer Credit Act 1974/1979, the credit card issuer is equally liable for the transaction. Therefore, if you have a problem with the product/service, you have a second door to knock-on! Please refer to the following: |

|

|

Consumer Credit Act “Paying for goods or services by credit card is now a major part of daily life, with many people preferring this method of payment to using cash or cheques. An advantage of using a credit card is that, under section 75 of the Consumer Credit Act 1974, customers who have a claim against a supplier for breach of contract or misrepresentation will generally have an equal claim against the card issuer. |

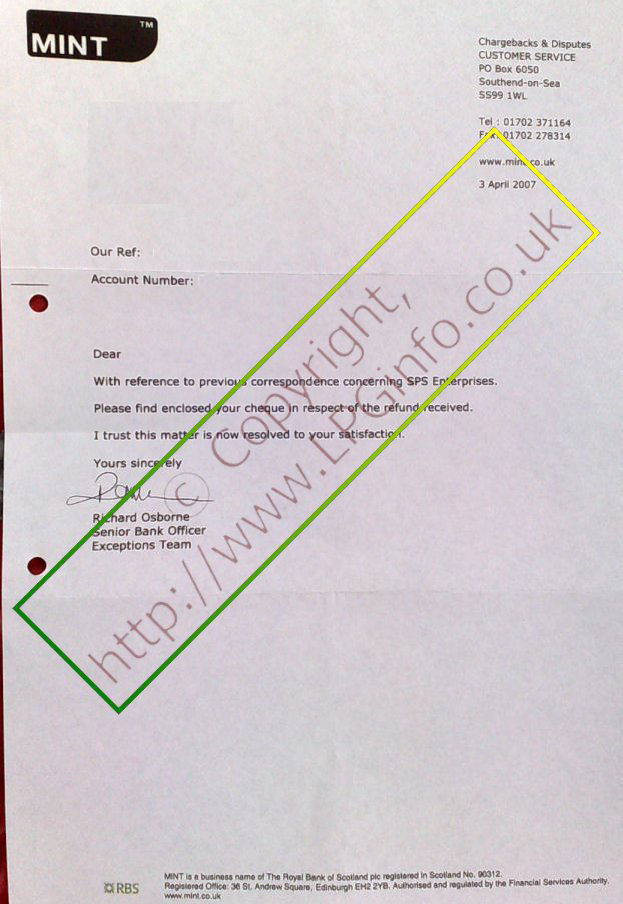

My transaction with Mr Steven P Sparrow of Go LPG Luckily, I paid for the transaction with Mr Steven P Sparrow of Go LPG using my MINT Credit Card. Having worked in the Financial Services industry, I knew that all credit card companies have a 'charge-backs' department. 'Charge-backs' (officially known as the Retail Disputes Department) is typically for disputes involving small transactions within around 90 days of purchase. Therefore, although this was not applicable as my transaction was quite large and it had been longer than three months, writing to the Retail Disputes Department was the first stage in the process. The Retail Disputes Department passed my letter to the 'Exceptions Department' who deal with all other claims, particularly those that concern the Consumer Credit Act. I rang the Exceptions Department to learn that they had begun looking at my case and was advised that it would go a long way if I could provide INDEPENDENT substantiation of my claims. Throughout this time, I was in touch with Mike Chapman of the LPGA and he said that the only way to proceed was to have an independent inspection done by an LPGA Approved Installer. As I was now back in Birmingham for the weekend, I looked up local LPG installers and came across Birmingham Autogas. Now, bearing in mind it was a Saturday morning and I had provided no notice, I asked if I could take my car down and if they could have a look. I found Birmingham Autogas to be highly accommodating and friendly - especially since they remembered a previous message I posted on the now defunct LPGForum (which was removed as the forum administrator seemed very friendly with 'Go LPG'). There are also lots of taxi drivers that have been converted by these guys. Birmingham Autogas were so appalled with the installation that they decided to conduct an LPGA Inspection there and then! The following weekend I decided to visit RSJ Motors (an Independent BMW Specialist with over 25 years experience) in Birmingham. The previous owner of my car took it there for servicing and hence, they knew the history of the car. They tested the car on petrol and LPG, carried out a full Autologic Diagnostic Test and examination of the installation. They then also produced an Independent Report slating the installation by Mr Steven P Sparrow of Go LPG as well as the Romano N system. Armed with the two independent reports, I wrote yet again to the Exceptions Department.. waited a couple of weeks... and success! The independent reports and case I put forward provided irrevocable proof that Mr Steven P Sparrow of Go LPG contravened the Sale of Goods Act and Supply of Goods and Services Act 1982. It is worth bearing in mind that had I not made the original purchase on my credit card, I would have had to pursue Mr Steven P Sparrow of Go LPG through the courts. |

|

|

|